How Singapore's 360F collates self-reported metrics for better financial advice

The insurtech helps bridge the trust gap between advisors and clients.

It seems digitisation can only do so much.

Singapore’s life insurance industry recorded a 13% slump in weighted new business volumes in H1 2020 to $1.21b (S$1.66b), according to a report by the country’s Life Insurance Association (LIA). Annual premium business plunged 25% to $762.9m (S$1.04b), dragged down by the Circuit Breaker and Phase 1 periods. Total sum assured only increased a measly 1% to $48.1m (S$65.6m) from $47.6m (S$64.9m) a year ago.

In terms of distribution channels, tiered representatives comprised 36.1% or $440.7m (S$600m) of total weighted premiums, ahead of bank representatives (30.3%), FA reps (26.7%) and online direct channels (2.6%).

In addition to lockdown measures, another possible reason for the feeble uptake of insurance is the lack of trust towards financial advisors and the quality of advice being given, said Michael Gerber, founder and CEO of Singapore-based insurtech 360F. He cited a study by the Geneva Association, a global alliance of insurers, saying that two in three do not trust advice being given by financial advisors.

“From our experience and research, incumbent players have not been able to make the quality of their advice systematically measurable or transparent. This in turn makes consumers feel disempowered, and distrustful of financial advisors,” he explained.

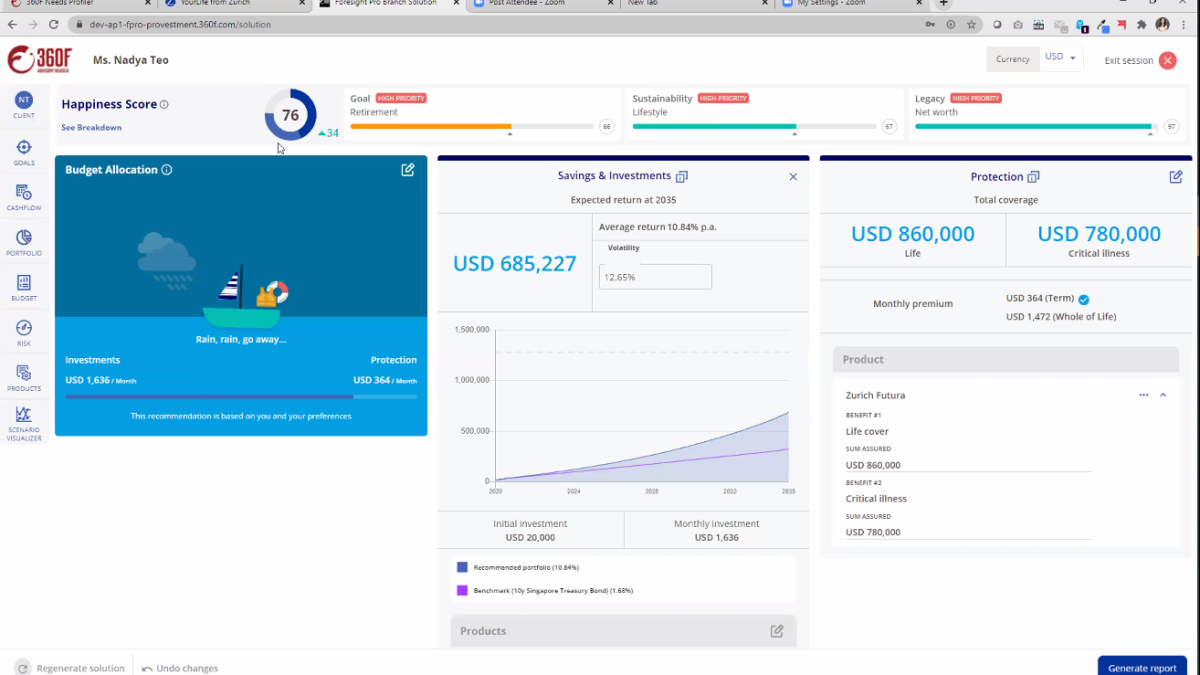

To fill this gap, he and co-founder Clarie Kwa established 360F, which offers banks and insurers a platform that allows financial advisors to build hyper personalised solutions for their clients in real time through its flagship product 360-ProVestment.

“At 360F we have a firm grounding in behavioural modelling and optimisation techniques, complemented by expert domain understanding of actuarial science and financial products, and steered by fieldwork experience. This allows us to create optimised recommendations that truly address consumers’ needs.”

Insurance Asia caught up with Gerber to discuss the early days of 360F and how they have grown over the years, what makes them different from other insurtechs, what makes clients wary of financial advisors, what their plans are amidst the pandemic, and what the future holds for the company.

What is the story behind 360F? What pushed you towards this venture?

Year after year, studies sponsored by governments and private institutions tell us about the protection gap and poor retirement readiness among consumers. People are becoming more affluent, regulators are giving more scrutiny to insurance providers, and technology has become more advanced and widespread. Yet these problems persist.

My co-founder and I think the root cause is the quality of advice. If a consumer were to visit three advisors with the same problems, he or she can expect three very different pieces of advice on product recommendations. Why does this bizarre situation happen? It’s because the process of constructing advice is traditionally guided solely by principles and hypotheses - which leaves a lot of room for subjectivity.

We therefore created 360F to transform the quality of advice, to help consumers attain their self-defined financial resilience and freedom.

How have you grown over the years, both profit- and innovation-wise?

We are now in our third year of business, still bootstrapped but already profitable with a respectable margin. In fact, our revenue multiplied five-fold over the last year. Powering and sustaining this growth is our agility to innovate and pivot. Today, we have developed a suite of products that support the advisory and direct-to-consumer businesses, many of which are indisputable firsts in the market and deliver tangible business benefits.

For example, to our best knowledge, 360-ProVestment is the first-ever recommendation engine that supports both insurance and investment products, making holistic planning a breeze. We are also the first to be able to quantify advice quality reliably. We have a proprietary scoring method that measures the customer’s current and expected fulfilment of the self-defined financial resilience and freedom, making it possible for anyone to easily assess the quality of financial advice in their own context.

What makes you stand out from other insurtechs who provide similar services?

We dare say no other insurtechs provide similar services.

Too often, we feel the need to call out on dubious market innovations. For example, some tools try to make financial planning more efficient and ‘fun’ by recommending needs and coverage based on what “others like you have”. This practice misleads consumers in the name of big data and AI, as it makes the fallacious assumption that most people have the ideal insurance coverage and investment portfolio. Quite the contrary, the issues of protection gap and poor retirement readiness exist perennially, even in mature economies like Singapore.

In your opinion, what is the main reason for the decline of trust in financial advisors? Is this something that would likely be sustained in the future?

I would say that there are two main reasons. Information is now more accessible than ever. Of course, there is still ample room growth in terms of financial literacy, even in the mature economies. However, consumers now have more channels to seek counsel, and they have therefore become more aware of their rights and options. For example, there is now a trend to consult advisors and consumers in public forums for a recommendation someone else had given. With second opinions readily available on the Internet, consumers are unlikely to take advisors’ advice at face value.

Past market crises have left a bad taste for many whose financial products became a liability or even worthless. Crisis cycles run shorter now, so bitter memories are fresh, even for the generation who grew up during the last crisis. Due to these two reasons, I would say consumers will be increasingly skeptical of financial advisors. As such, there is an urgent need to provide consumers with quality advice to restore this trust deficit.

How has your approach to insurance changed as the pandemic rages on? Have you, or are you planning on modifying your products in response to the crisis?

The pandemic has motivated many to consider purchasing insurance and investment products independently. However digital direct channels for financial services may not be sustainable, as the cost of customer acquisition has risen to the level of outpacing customer lifetime value. Rather than us changing our approach to insurance, I would say the current pandemic has actually made the use case for our products even more prominent.

Recently, 360F enabled a global insurer in Dubai to cope and grow by remotely implementing its first digital direct sales channel within 4 weeks. Their channel uses 360- NeedsProfiler®, which is a predictive and interactive engagement tool that helps customers self-learn and become aware of their unique needs to achieve financial resilience. By making intent and personalisation salient, it has improved conversion rates and customers’ readiness to open up in follow-up virtual advisory sessions. The contextual analytics generated from the profiler have also helped advisors to better engage first-time customers, even if remotely.

Pre-pandemic, 2 in 3 did not trust investment advisors and insurance agents. Social distancing measures because of the pandemic have meant fewer in-person interactions usually required to convey complex information, making it even harder to build trust. To address this challenge, we recently helped a financial advisory firm to build trust with its prospects online by implementing its first digital advice platform comprising our 360-ProVestment® and 360-HappiU® modules. Powered by optimization capabilities, the platform generates a score that measures the expected fulfilment of one’s expectations. The resulting financial recommendation is holistic and hyper-personalised, which convinces customers to make the purchase. By automating the complex process of finding the right balance of products for each customer, and by providing quantitative support for the financial advisor’s recommendations, our approach to advisory complements trends for remote digital advisory that have been propelled by the pandemic.

Can you give a quick walkthrough of how your recommendation optimiser works? It was mentioned in your website that it is “hyper-personalised” - what makes it so, and what factors are taken into consideration?

To hyper-personalise advice systematically, 360-ProVestment® views the customer as an unique individual. It integrates itself into the financial institution’s existing customer journey, and then transforms customer data into a mathematical utility function unique to the customer. This function reflects the customer’s financial needs, aspirations, lifestyle preferences and constraints such as money and time. This function allows a numerical and personalized score (What we call HappiU) to be associated with the candidate products and/or solutions’ effect on the customer’s financial resilience and happiness, which they have defined for themselves. With this, the application goes on to prepare scenarios for stress testing.

360-ProVestment® then stress-tests the millions of possibilities within seconds to construct a financial solution that not only matches the customer’s preferences, but also yields the highest fulfilment in terms of their own self-defined financial resilience and financial freedom. The customer is free to explore alternative scenarios - all of which are based on his or her own data - before settling on what they personally find most perfect for them.

It was mentioned that in terms of affordability, “advice is seldom effective” when gauging which product meets clients’ time and money constraints. Can you expound on this?

Consumers want to protect not only their financial futures, but also their loved ones’. On the other hand, they are constrained by their time and budgets, and need advice on the most cost-effective solution possible. Yet advisors are ill-equipped to find out what exactly is the optimal combination, and may therefore end up underselling, overselling, or recommending irrelevant products.

We all have unlimited wants and needs but limited time and money. By understanding how badly a customer wants to achieve each goal, it’s possible to find the combination of products that meets his or her constraints while fulfilling their obligations and achieving their dreams as much as possible. As for time constraints, while an advisor with no more than an Excel spreadsheet could take months to sieve through actuarial data, it takes only seconds for our program to cycle through millions of scenarios of what could happen to the user. It then tests different permutations of products to see how close they come to achieving the stated goals.

Do you think 360F can eventually take the place of financial advisors in the future? Why or why not?

360F automates advice. It uses technology to help facilitate trust formation. But 360F cannot automate relationship building. Impactful innovations are human-inspired, science-backed and technology-enabled. 360F augments, but does not replace, human intelligence and enhances human capabilities to transform and scale businesses.

In the next two to three years, we envision our product suite to be applied en masse to the industry, reshaping the nature of the financial advisor’s work. The art of advisory tapping on communication skills unique to humans will make a grand comeback.

What’s next for 360F? Can you share with us any partnerships or projects in the pipeline?

We foresee using our technology-in-production for an advice exchange platform that brings customers, advisors and product carriers together, while ensuring the integrity of advice and viability of the advisory business.

Advertise

Advertise